SBI Car Loan

State Bank of India offers car loans to its customers with interest rates ranging between 8.70% and 15.60% p.a. and a tenure of up to 7 years.

Overview of SBI Car Loans

Features | New Car Loan Scheme | Used Car Loan Scheme |

Interest Rate | 8.70% p.a. onwards | 10.45% p.a. – 15.60% p.a. |

Loan Tenure | Up to 7 years | Up to 5 years |

Processing Fee | 0.40% of loan amount (Min Rs.1,000; Max Rs.10,000 + GST) | 1.25% of loan amount + GST (Max Rs.10,000) |

Loan Amount | Up to 100% of car’s on-road price | Based on vehicle valuation and bank policy |

Eligibility | Salaried, self-employed and professionals | Salaried or self-employed buying certified used cars |

Credit Score | Best rates for CIBIL score 700 & above | Rate depends on CIBIL score and vehicle age |

SBI Car Loan Eligibility

To be eligible for an SBI New or Used Car Loan, applicants must adhere to the below-mentioned SBI car loan eligibility criteria:

- Applicant/individual must be aged between 21 years and 70 years.

- The applicant must be either a Central/State Government employee, a professional or self-employed individual, or an individual who is engaged in agricultural and allied activities.

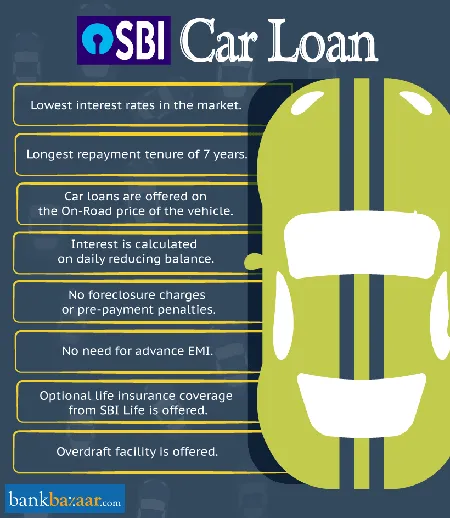

Key Features of SBI Car Loan

The main features of the car loan offered by SBI are mentioned below:

- Competitive EMI and car loan interest rates

- Repayment tenure of 8 years

- Provides financing on the On-Road price

- Interest is computed based on Daily Reducing Balance

- No Advance EMI

- Optional Life Insurance Cover from SBI

Car Loan Schemes Provided by SBI

The list of car loan schemes provided by SBI is given below:

Scheme | Loan Details | Eligibility & Features |

Loan up to 90% of on-road price. Tenure: Up to 7 years (84 months). | Available for purchase of new passenger cars, SUVs, and MUVs. Applicant age should be between 21 and 70 years. Optional SBI Life Insurance cover available. | |

Loan amount from Rs.3 lakh to Rs.10 lakh. Tenure: Up to 5 years or 8 years minus the vehicle’s age (whichever is lower). | For purchase of certified used cars not older than 5 years. Applicant age: 21–65 years. Vehicle must be certified by authorized dealers. | |

Loan up to 100% of on-road price. Tenure: Up to 7 years. | Exclusive for existing SBI Home Loan customers. Minimum annual income of ₹2 lakh required. | |

SBI Assured Car Loan | Loan from Rs.2 lakh and above. Tenure: 3 to 7 years. Margin: 100% of FD value. | Offered to SBI Fixed Deposit holders against their FD value. Loan available without income proof, based on FD. |

Loan up to 100% of on-road price. Tenure: 3 to 8 years. | Specifically for purchase of electric vehicles (EVs). Applicant age: 21–70 years. Lower interest rate compared to regular car loans. |

SBI Car Loan EMI Calculator

Use the SBI Car Loan EMI Calculator to easily estimate your monthly instalments before applying for a loan. Just enter the loan amount, interest rate, and tenure, and the calculator will show you how much you need to pay each month—helping you plan your budget better.

Documents Required for SBI Car Loan

Category | Documents Required |

Salaried Employees | • Bank account statement for the preceding 6 months • 2 passport size photos • Proof of address • Identity proof • Proof of income: – Latest pay slips – Form 16 – Income Tax Returns or Form 16 for the preceding 2 years |

Non-Salaried / Businessmen / Professionals | • Bank account statement for the preceding 6 months • 2 passport size photos • Proof of address • Identity proof • Proof of income: – Income Tax Returns for the preceding 2 years – Form 16 for the preceding 2 years – Audited Balance Sheet – P&L statement for the preceding 2 years – Sales Tax Certificate – Partnership Copy |

Individuals Engaged in Agricultural and Allied Activities | • Bank account statement for the preceding 6 months • 2 passport size photos • Proof of identity • Proof of address • Direct agricultural activity • Allied activities (poultry, dairy, plantation, horticulture): Evidential proof of the activities running must be provided |

How to Apply for an SBI Car Loan

Applying for an SBI Car Loan is a simple and hassle-free process. You can choose to apply either online from the comfort of your home or visit a nearby SBI branch to submit your application in person. Here’s how it works:

✅ Online Application Process

- Visit the SBI Website Start by going to the official SBI website where you can explore various car loan schemes tailored to meet your needs.

- Select the Loan Scheme Choose the car loan option that best suits you, such as a new car loan or a loan for a certified pre-owned vehicle.

- Fill in the Application Form Enter your personal details, employment information, and vehicle preferences in the online application form.

- Upload Required Documents Upload scanned copies of necessary documents like identity proof, address proof, income certificates, and bank statements. This helps SBI assess your eligibility.

- Submit the Application After verifying that all details are accurate, submit the form for review.

- Document Verification and Loan Disbursement Once your documents are verified and everything is found to be in order, the loan amount is approved and disbursed directly into your bank account.

✅ Offline Application Process

- Visit the Nearest SBI Branch Head to the closest SBI branch and request the car loan application form.

- Fill Out the Form Complete the form by providing all required details related to your personal background, income, and the car you wish to purchase.

- Attach the Documents Submit the form along with the necessary documents such as identity proof, income proof, address proof, and bank statements.

- Loan Processing and Approval The bank will verify your application and documents. Once satisfied, the loan will be sanctioned and the amount will be credited to your account.

FAQs on SBI Car Loan

- What are the different makes of vehicles financed by SBI?

SBI finances all makes of new and used cars. The used car being financed, however, must not exceed 5 years in age. The applicant can choose any make or model for financing.

- What are the factors based on which the EMI is calculated?

The car loan EMI is computed considering factors such as loan tenure chosen by the applicant. The EMI will be higher if a shorter tenure is chosen as compared to a long tenure.

- What is the security that needs to be furnished with respect to SBI Car Loan?

A certain charge on the financed vehicle is submitted to the Local Transport Authorities. Your spouse will have to be the guarantor in case his/her income has also been considered for determining the loan amount. Other securities may be mandated, varying from one applicant to another.

- What are the elements included in the 'On-Road Price' of the vehicle?

Include only if you're linking to loan eligibility or calculation context. Otherwise, remove to avoid dilution.

- Can my spouse be a co-borrower?

Yes, your spouse can join in on the car loan as a co-borrower. In that case, his/her income will be included.

Car Loan Articles

- Car Prices in India

- How To Transfer a Car Loan to Another Person

- How GST Affected Car Prices in India

- Car Lease Vs Car Loan

- Car Loan Foreclosure Procedure

- Vehicle Registration

- Car Loan Document Checklist

- Bad Credit Car Loan

- Car Loan Refinancing

- Zero Downpayment Car Loan

- Commercial Car Loan

- Car Loan for Nris

- Car Loan Schemes for Women

- Car Loan Preclosure

- Transfer Car Registration

- Top 10 Banks for Car Loan

- Car Loan Schemes for Government Employees

- Fuel Efficient Sedan Cars

- Automatic Cars for Women

- Chepest Cars in India

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.